In the world of investments, understanding how your money can grow over time is crucial. A Compound Interest Calculator is an indispensable tool for anyone looking to maximize their savings or investment potential. By helping to visualize the power of compound interest, this calculator can guide you in making informed decisions about your financial future.

What is a Compound Interest Calculator?

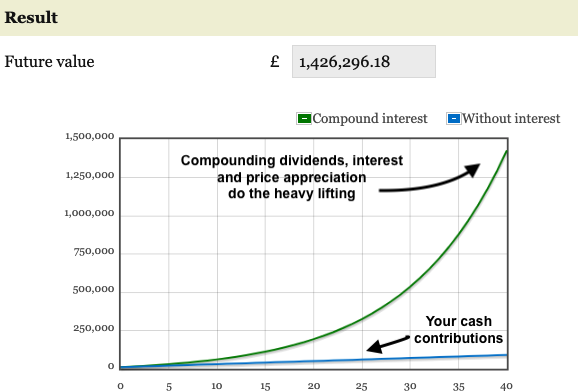

A Compound Interest Calculator is a financial tool that calculates the interest on an investment based on the principal amount, rate of interest, and time period. Unlike simple interest, compound interest earns interest on both the initial principal and the accumulated interest from previous periods. This method of interest calculation allows your investments to grow exponentially over time.

How to Use a Compound Interest Calculator

Using a Compound Interest Calculator is straightforward. You need to input the principal amount, the annual interest rate, the number of times the interest is compounded per year, and the number of years you plan to keep the investment. Some calculators also allow you to include regular contributions to your investment, further boosting your compound growth.

Step-by-Step Guide

- Enter the Principal Amount: This is the initial sum of money you intend to invest.

- Input the Annual Interest Rate: This percentage reflects how much your investment will grow each year.

- Select the Compounding Frequency: Common frequencies include annually, semi-annually, quarterly, or monthly.

- Specify the Investment Duration: Enter the number of years you plan to hold the investment.

- Include Additional Contributions (Optional): Indicate any regular contributions you plan to add to your investment.

Benefits of Using a Compound Interest Calculator

- Visualize Growth: See how your investment grows over time with compound interest.

- Plan Effectively: Make informed decisions on how much to invest and for how long.

- Compare Options: Evaluate different investment strategies by adjusting variables like interest rates and contribution frequency.

Applications Beyond Personal Savings

Compound Interest Calculators are not only limited to personal savings accounts. They are equally beneficial for calculating returns on other investments such as real estate, retirement accounts, and other financial assets. Tools like the Ramsey Investment Calculator and investment withdrawal calculators can complement these calculations, providing a comprehensive view of your financial landscape.

Conclusion

A Compound Interest Calculator is an essential investment tool for anyone looking to understand and harness the benefits of compound interest. By providing clear insights into how your money grows, it empowers you to make strategic financial decisions. Whether you’re planning for retirement, saving for a major purchase, or simply aiming to boost your portfolio, this calculator is your guide to a prosperous financial future.

Start using a Compound Interest Calculator today and take the first step towards smarter investing. Your future self will thank you for it.